How does SEO work for Fintech? – Things to Consider

Competition and rapid change characterize the fintech sector. To be successful in the financial market, a new company must be able to distinguish itself from the established players and maintain an advantage over them.

Using SEO and digital marketing approaches that can effectively promote a brand, expand a customer base, and build consumer confidence, a new business can do just that. The startup may have a hard time overcoming this challenge if it doesn’t know where to start.

or what strategies to use.

What does it matter if you use Google or another search engine? After all, aren’t you the one who doesn’t have to pay them? So you’re not paying them, after all … However, someone else is doing it. So why do they care? Because advertisingâ & # x20AC; & # x2122;

it’s how they make their money.

Organic results and pay-per-click ads are shown on the SERP (or PPC). SEO has an impact on organic results, while & # xD;

& # xD;

PPC advertising is purchased. No search engine, including Google, will allow you to buy a place in organic results.

SEO stands for Search Engine Optimization, which is a digital marketing technique that aims to improve the visibility of your website in search results on search engines such as Google. The more you understand how search engine optimization works, the more methodsâ & # x20AC; & # x2122;

you can use it to improve the ranking (or exposure) of your search engines.

Every information we might need is just a few clicks away. People go online when they need information, services, goods, and so on. Startups may be able to solve this problem with the help of an SEO company. Below is & # xD;

are some SEO tactics for Forex that can help new fintech technology companies reach new customers and generate more online traffic. For search engines to gain your trust, they must continually & # xD;

provide you with relevant, high-quality results for your search queries.

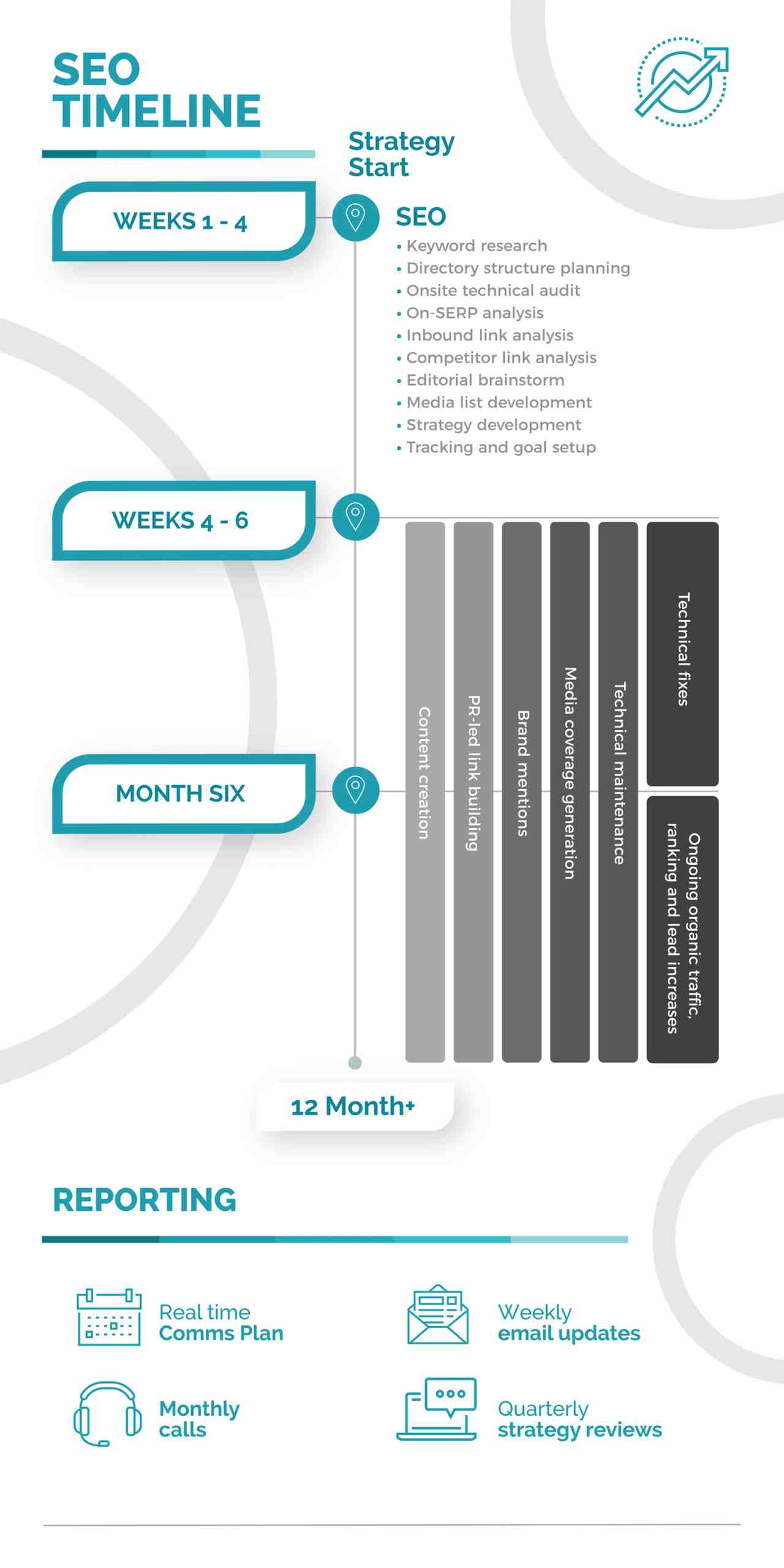

What you need to know about implementing your SEO strategy

This technology-driven environment requires start-ups to spend more on digital advertising to reach potential customers. Even if conventional advertising may not be completely out of the picture. Interest, habits, finance & # xD;

the situation and demands of the target audience must be taken into account when developing an advertising strategy. Understanding what the startup target audience is looking for will make it easier for the company to come up with concepts that & # xD;

it will reach and attract the target population.

Search engine optimization depends heavily on keyword selection. To be effective, the content must be well-written, easy to understand, and attractive to read. Educate visitors about the financial market or offer them tips to help them improve & # xD;

merchants.

What are the 4 growth strategies?

Long-tail keywords can be used to identify content that is relevant to a website. With long tail keywords, search engines can get an idea of what they are looking for. Despite the importance of using & # xD;

High ranking keywords in the content pages of the website, it is also crucial that the material is presented in a logical order. An additional requirement for website material is that it must & # xD;

What are the types of growth strategies?

be unique and not just copy yourself from other sources.

What are the 7 growth strategies?

The link to a website with a known domain name is known as an inbound link. This means that the anchor text or destination keywords used in a backlink should match those in the site they are pointing to.

What are the 3 growth strategies?

The presence of a fintech start-up company on social media is not enough; it should also be highlighted in the business community. Startups could connect with their target audience and create leads through these channels. Share your best practices for businessâ & # x20AC; & # x2122;

What is the best growth strategy?

and invest with other startups.

Which growth strategy is the easiest?

In order to improve your website’s visibility in search engine results, a new estate technology business could make use of the SEO approaches mentioned above. A thorough site evaluation and market research must be done before an SEO strategy can respond to the businessâ & # x20AC; & # x2122;

What are the 3 growth strategies?

requirements and succeed. Businesses use SEO for content as it attracts visitors and customers.

Which company has the best growth strategy?

| Keep reading if you’re ready to start creating SEO content for your business. In this piece you will not only learn how to produce SEO content, but you will also learn how to write great content in general. | The SEO-friendly content creation process includes keyword research, content creation, and more. | SEO relies heavily on inbound links. Search engines use inbound links (links from other websites) as a quality vote. In addition, outbound links (links to other websites) help readers access additional information about your topic. |

|---|---|---|

| When it comes to creating inbound links, your main goal should be to produce high quality content and spread it through various public relations and social media. Don’t post links to your site in forums or comment areas, and don’t buy & # xD; | links from other site owners, either. Always check the relevance and usefulness of the sites and pages you link to before placing an outbound link. | Linking to junk and low quality sites can cause search engines to rank your site in the same category. |

| If you have the resources, it’s a good idea to experiment with various forms, such as video, audio, and images. Visitors love images, videos, and infographics, and they can be a wonderful way to get links back to your site. | There are four basic growth strategies you can use to expand your business: market penetration, product development, market expansion, and diversification. | What are the 4 types of business strategies? From these decisions emerge four generic strategies at the business level: (1) cost leadership, (2) differentiation, (3) focused cost leadership, and (4) focused differentiation. In rare cases, companies may offer low prices and unique features that customers consider desirable. |

| Some common growth strategies in business include market penetration, market expansion, product expansion, diversification, and acquisition. | Therefore, truly successful companies rarely rely on a single plan of action. Instead, they combine multiple growth strategies to win, such as market development, disruption, product expansion, channel expansion, strategic partnerships, acquisitions, and organic growth. | The following are three customer growth strategies: (1) Growth of the core business, (2) Growth by customer sub-segmentation, and (3) Growth of adjacent opportunities. |

| Product expansion or diversification Developing new products or adding new features to existing ones can be a very effective business growth strategy. Product development allows you to attract new audiences who may not have been interested in your brand before. | 1. Market penetration. This is the least risky and potentially easiest growth strategy. It involves increasing the sales of your existing product in your existing market. | The following are three customer growth strategies: (1) Growth of the core business, (2) Growth by customer sub-segmentation, and (3) Growth of adjacent opportunities. |

How fast is the fintech industry growing?

Company

Industry

- Price

- McKesson

- Medical distributors

- 28.99

- Eckerd ****

- Drugstore chain

- NA

- Sainsbury’s

Is the fintech market growing?

Grocery store chain

How big is the fintech industry in 2021?

21.55

Is fintech a growing industry?

Fluorine

Is fintech a fast growing industry?

Engineering and construction

How big is the fintech industry in 2021?

40.73

What is the size of the fintech industry?

The global fintech market was worth $ 127.66 billion in 2018, with a projected annual growth rate of ~ 25% by 2022, to $ 309.9 billion. It is still very small compared to the global financial services market.

Is fintech a fast growing industry?

Which fintech company is growing the fastest? As a result, we have compiled a list of the ten fastest growing fintech companies to see in 2022.

How many Fintechs are there in 2021?

8) Grab the financial group. …

Is fintech a growing field?

7) Dapper Labs. …

Is fintech a good career path?

6) Rapyd. …

Is the fintech industry growing?

5) Mollie. …

Is fintech a fast growing industry?

4) Fenergo. …

What are the characteristics of FinTech?

3) Commercial Republic. …

2) BharatPe. …

What are the pillars of fintech?

1) BlockFi. US-based company BlockFi was founded in 2017 and specializes in cryptocurrency lending.

What are fintech three pillars innovation?

The largest segment of the market will be Digital Payments with a total transaction value of US $ 8,562,932 million in 2022. The average transaction value per user of the alternative financing segment is expected to amount to US $ 35,713 in 2022. expects the Neobanking segment to show revenue. growth of 39.9% in 2023.

What is the core of fintech?

According to Crunchbase, a record year with 151 new unicorns, venture capital financing to private fintech companies topped $ 134 billion in 2021, up 177% from a year earlier.

What are 4 categories of fintech?

From 2015 to 2019, the adoption of FinTech doubled every 2 years. 96% of consumers now know at least one FinTech service and have used one before. According to the Market Data Forecast, the global FinTech market is expected to reach $ 324 billion in 2026, growing at a CAGR of 23.41%.

What are 4 categories of fintech?

Fintech is one of the fastest growing technology sectors, with companies innovating in almost every area of finance; from payments and loans to credit score and stock trading.

What does fintech consist of?

According to Crunchbase, a record year with 151 new unicorns, venture capital financing to private fintech companies topped $ 134 billion in 2021, up 177% from a year earlier.

What is the core of fintech?

Fintech Market Statistics Fintech’s global market is expected to grow at a CAGR of around 20% over the next four years. Market value is expected to reach about $ 305 billion by 2025, according to GlobeNewswire.

How would you describe fintech?

Fintech is one of the fastest growing technology sectors, with companies innovating in almost every area of finance; from payments and loans to credit score and stock trading.

How do you explain fintech?

As of November 2021, there were 10,755 fintech (financial technology) startups in the U.S., making it the region with the most fintech startups in the world.

What is an example of fintech?

A 2020 report by Research and Markets found that the global fintech market is expected to grow at a compound annual growth rate (CAGR) of around 20 percent between 2020 and 2025, reaching a value of 305 billion of dollars at the end of this period.

Will fintech continue to grow?

From programming to AI and beyond, a fintech STEM career is full of endless opportunities. Cybersecurity, artificial intelligence, application development, risk and compliance, and data science are white areas with a significant shortage of talent.

How much is the Fintech industry growing? IDC’s market research organization indicates that the sector’s growth rate will average 25% by 2022, reaching a market value of $ 309 billion.

Is there a future in fintech?

Fintech is one of the fastest growing technology sectors, with companies innovating in almost every area of finance; from payments and loans to credit score and stock trading.

What will be the future of fintech?

The most talked about (and most funded) fintech startups share the same characteristic: they are designed to be a threat, to challenge, and ultimately usurp traditional financial service providers rooted in being more agile, serving an unattended segment, or offering faster and / or or better service.

Is fintech a good field?

What is so special about fintech? FinTech simplifies financial transactions for consumers or businesses, making them more accessible and generally more affordable. It can also be applied to companies and services that use AI, big data, and encrypted blockchain technology to facilitate highly secure transactions between an internal network.

Is fintech good investment?

I have become adept at answering and always say that “In most cases, fintech is built on a set of 4 pillar technologies: social, analytical, cognitive and blockchain.” These four technologies are used in different ways to create most of the fintech you use or read.

Is the fintech industry growing?

Financial services know the “other pillars” of the Basel Accord. This framework aims to promote global economic growth by subjecting financial institutions to (1) minimum capital requirements, (2) rigorous supervisory review, and (3) rules of market discipline.

How big is the fintech industry in 2021?

There are four main areas in which they work: payments and transactions, personal financial management (PFM), investment negotiation and consulting platforms, and new financing agreements and credit models.

How much will the fintech industry grow?

In this handbook, we will highlight four fintech areas (digital lending, payments, blockchain, and digital wealth management) that are of particular interest for their rapid growth rate, technological disruption, and regulatory and other risks.

Is there a fintech ETF?

In this handbook, we will highlight four fintech areas (digital lending, payments, blockchain, and digital wealth management) that are of particular interest for their rapid growth rate, technological disruption, and regulatory and other risks.

A Beginner’s Guide to 2022. FinTech (financial technology) is a general term that refers to software, mobile applications, and other technologies created to enhance and automate traditional forms of financing for businesses and consumers.

Does fidelity have a fintech ETF?

There are four main areas in which they work: payments and transactions, personal financial management (PFM), investment negotiation and consulting platforms, and new financing agreements and credit models.

Does Fidelity have a QQQ equivalent?

| Fintech, or financial technology, is the term used to describe any technology that provides financial services through software, such as online banking, mobile payment applications, or even cryptocurrency. | “Fintech is any company that uses technology to support financial services of any kind,” said Rhodes-Kropf, which may include regulatory technology, loans, payments, savings, investment, insurance, automatic advice, accounting, risk. management, processing of claims and subscription. | |

|---|---|---|

| Examples of FinTech. Some well-known companies such as Personal Capital, Lending Club, Kabbage and Wealthfront are examples of FinTech companies that have emerged in the last decade, offering new twists to financial concepts and allowing consumers to have more influence on their financial results. | Investments in Fintech have reached $ 91.5 billion in 2021, almost doubling last year’s total. The global technology market is expected to reach $ 324 billion in 2026, growing at a CAGR of 23.41%. Linked to this growth, there have been significant movements within the senior management of companies in the sector. | Is fintech a fast growing industry? Fintech is one of the fastest growing technology sectors, with companies innovating in almost every area of finance; from payments and loans to credit score and stock trading. |

| “The future of fintech is increasingly specialized and depends on technological progress and innovation. Its dependence on these two factors will continue to drive disruptive business models in financial services. | The fintech market is adopting blockchain and it has come to stay. According to Future Market Research, the global fintech market blockchain is expected to expand from $ 231.63 million in 2017 to $ 6.7 billion in 2023, with a compound annual growth rate (CAGR) 75.2 percent during the forecast period. ” € | Fintech is undeniably beneficial to organizations, as technology continues to redefine our daily lives. With the pressure to stay ahead of the competition and continually adapt, there is a growing demand for STEM talent in finance that has the capabilities to manage disruptive technology. |

Does Fidelity have a technology index fund?

A Great Scenario for Long-Term Growth Investors To be perfectly clear, investing in fintech stocks is not for investors with little tolerance for volatility and risk. Like any exciting new industry, fintech is likely to be a bit of a roller coaster ride as the industry matures.

What is fintech stock?

How much is the Fintech industry growing? IDC’s market research organization indicates that the sector’s growth rate will average 25% by 2022, reaching a market value of $ 309 billion.

What is an example of fintech?

According to Crunchbase, a record year with 151 new unicorns, venture capital financing to private fintech companies topped $ 134 billion in 2021, up 177% from a year earlier.

Is fintech on the stock market?

The global fintech market was worth $ 127.66 billion in 2018, with a projected annual growth rate of ~ 25% by 2022, to $ 309.9 billion.

What is fintech stock symbol?

| The Global X FinTech ETF (FINX) aims to invest in companies at the forefront of the emerging financial technology sector, which includes a number of innovations that help transform established industries such as insurance, investment, fundraising and third party mobile loans. and digital solutions. | Is there a fintech index? The Indxx Global Fintech Thematic Index is designed to track the performance of companies trading in developed markets that offer technology-driven financial services that are altering existing business models in the banking and financial services sectors. | FSVLX – Fidelity ® Select FinTech Portfolio | Loyalty investments. |

|---|---|---|

| ONEQ | QQQ | First name |

* This article was originally published here

Comments

Post a Comment